California tax revenue dips but surplus remains

- Share via

California tax revenue slowed in February but is still far outpacing expectations, according to a report released Friday.

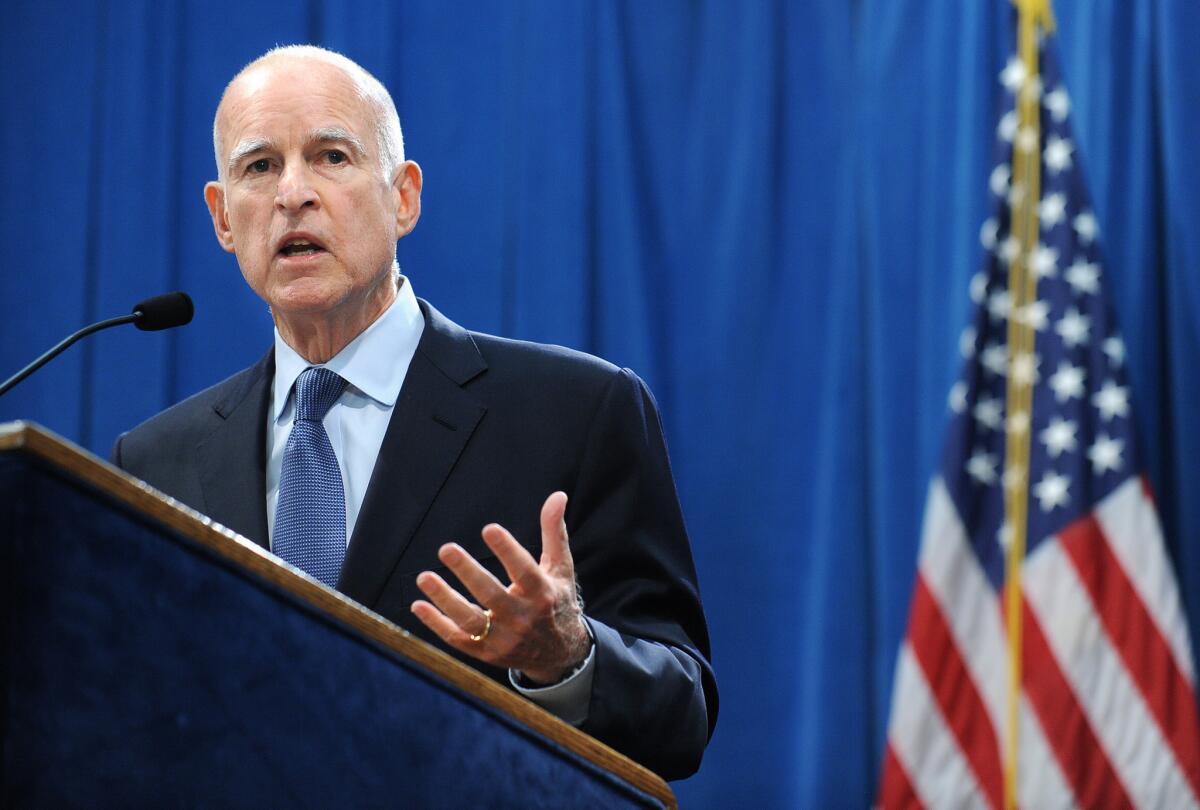

The report, released by Gov. Jerry Brown’s Department of Finance, showed income tax revenue falling 20% below projections in February. Sales tax revenue fell slightly behind the month’s goal.

The shortfalls chip away at the state’s multi-billion-dollar surplus.

At the end of January, the state had collected $5.1 billion more tax revenue than expected. Now the excess revenue is pegged at nearly $4.8 billion.

Administration officials attribute the drop to an issue of timing. They say Californians likely paid their taxes earlier in the fiscal year, leading to a big revenue spike in January and the potential of smaller totals in the coming months.

Brown’s latest budget proposal counts on the state finishing the current fiscal year with almost $800 million leftover.

ALSO:

California taxes surge in January, report says

Proposition 30 win is no guarantee of fiscal safety

California furloughs for workers will prove costly, report says

Twitter: @chrismegerian

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.